Spread Betting and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67.8% of retail investor accounts lose money when trading Spread Betting and CFDs with this provider. You should consider whether you understand how Spread Betting and CFDs work and whether you can afford to take the high risk of losing your money

Spread Betting Money Management

Could I profit from Spread Betting?

Spread Betting can be a profitable trading strategy if your trades are aligned with the market’s direction. It’s important to remember that in Spread Betting, you are speculating on whether a market will rise or fall. While there is potential for profit, it’s essential to acknowledge the inherent risks involved and prioritise effective money management.

Successful Spread Betting relies on implementing sound money management techniques to mitigate potential losses and protect your capital. This includes setting appropriate risk levels for each trade, employing stop-loss orders to limit potential downside, and diversifying your trades to spread risk across different markets.

By carefully managing your risk and staying informed about market conditions, you can maximise the potential for profit while minimising the impact of potential losses. It’s crucial to approach Spread Betting with a disciplined mindset and continually evaluate your trades to ensure they align with your trading strategy and risk tolerance.

The importance of money management

Understanding and implementing effective money management and risk management practices are crucial for traders, especially beginners. It can be challenging to navigate the practical aspects of opening trades and determining appropriate stop-loss levels. To fully grasp this concept, let’s break it down.

Experienced traders recognise the importance of money management and risk management in their decision-making process. They understand how to balance these elements to achieve consistent success. Novice traders, however, may find it overwhelming to comprehend the interplay between these factors. It’s crucial to approach trading with a clear understanding of your risk tolerance and implement strategies accordingly.

Money management and risk management are closely related. Money management involves determining the appropriate allocation of funds for each trade and managing your overall trading capital. This includes setting a risk limit, such as a percentage of your account balance, for each trade. Risk management, on the other hand, focuses on protecting your capital by implementing stop-loss orders and adhering to predetermined risk-reward ratios.

When considering whether to open a trade, it’s important to evaluate the potential risks involved. Even if a trade appears enticing, it’s crucial to resist the temptation if the risks outweigh the potential rewards based on your money management and risk management parameters. Remember that leveraged trading, which is common in spread betting, amplifies both profits and losses.

To align money management with the decision-making process, traders should assess the potential risks and rewards of a trade and compare them against their risk tolerance and overall trading strategy. This ensures that trades are selected based on sound financial principles rather than emotional impulses.

It’s worth noting that comprehensive information on money management and risk management can be found in the “Trading Psychology” section of our Trading Guides. By understanding and applying these principles, traders can navigate the complexities of leveraged trading while safeguarding their capital.

Remember, effective money management aims to protect your capital, control risk, and optimise returns over the long term. It’s important to develop a consistent and disciplined approach to money management that suits your trading style and risk tolerance.

UK100 example

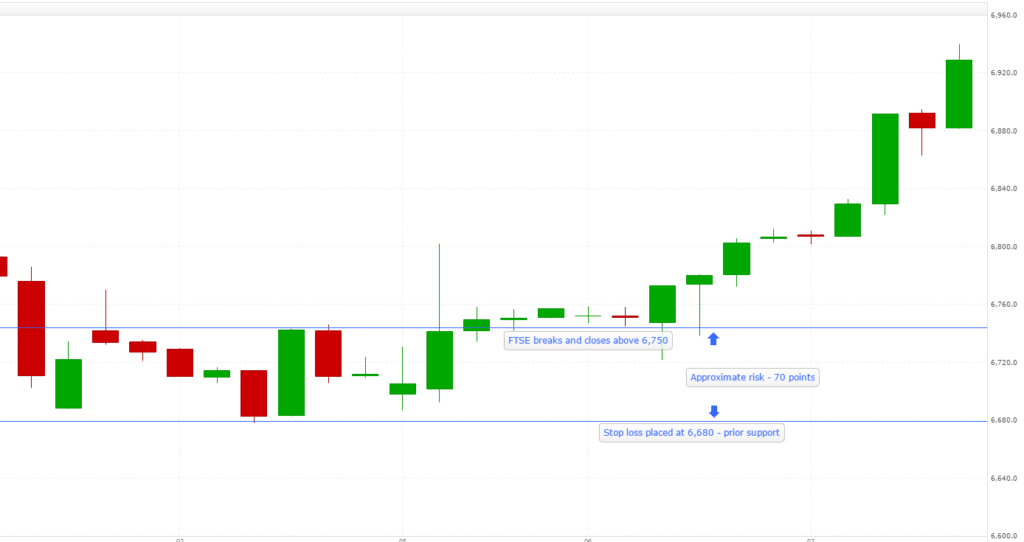

Let’s say that you have done your money management and divided up your risk capital so that you are prepared to risk £100 per trade. Now let’s assume that you’ve been watching the UK100 and waiting for a particular trade set-up. Let us say that you’re expecting the index to push higher but are waiting for the right moment to pull the trigger. We can see an example of such a set-up in this chart section below:

Analysing the left-hand side of the chart, we observe the following price movements on the UK100:

The UK100 initially dipped below the upper horizontal level around 6,750.

It then found support around 6,680, indicated by the lower horizontal level.

The price subsequently broke back above 6,750, showing some indecisiveness in the market.

Despite the indecisiveness, the UK100 managed to hold above 6,750, which can be seen as a positive signal to buy the index.

Now, we need to determine how much we should allocate for this trade, considering our maximum risk of £100 per trade, and where to place our stop-loss order. Based on the support around 6,680, we choose this level as the basis for our stop-loss. To provide some extra leeway, we decide to set the stop at 6,674, slightly below 6,680. This precaution is taken to account for potential selling pressure if there are market stops clustered around the 6,680 level.

Assuming we can buy the UK100 at 6,756, just above the support at 6,750, we calculate the risk by subtracting our stop-loss level from the opening level: 6,756 – 6,674 = 82 points. Considering our risk threshold of £100 per trade, we can place a £1 per point bet (1 x 82 points). However, a £2 per point bet would exceed our risk tolerance, even with a stop-loss distance of 82 points from the entry level. If the distance between the entry level and the stop-loss exceeds £100, it violates our money management rules, and we should avoid taking the trade.

Adhering to these rules might result in missing out on potentially profitable trades at times. While this can be frustrating, it is preferable to depleting your risk capital by disregarding your own rules. By preserving your risk capital, you also safeguard your mental capital, which is crucial for maintaining a healthy trading mindset. It’s important to exercise patience, discipline, and understand that choosing not to trade is still an active trading decision.

Disclaimer

Spread Co is an execution only service provider. The material on this page is for general information purposes only and nothing contained herein constitutes (or should be taken to constitute) financial or other advice which should be relied upon. It has not been prepared with your personal circumstances, financial situation, needs or objectives in mind, therefore any actions taken or not taken by any person on the basis of this material is done entirely at their own risk. Spread Co accepts no responsibility whatsoever for any such actions, inactions or resulting consequences. No opinion expressed in the material shall amount to (or be taken to amount to) an endorsement, recommendation or other such affirmation of the suitability or unsuitability of any particular investment, transaction, strategy or approach for any specific person. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. As such, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research. Nonetheless, Spread Co operates a conflict of interest policy to prevent the risk of material damage to our clients.

Recent guides

Easy To Open An Account

Reliable Platform

With our platforms you can trade wherever you are – at home, in the office, or when you’re out and about.

0% financing on short index positions

Some companies will charge you to hold a short index position. At Spread Co we won’t.

Powerful Charting

Spread Co charts are powered by TradingView Inc.

Sign Up For A Demo Account Create A Live AccountStart here

Markets

Spread Co Limited is a limited liability company registered in England and Wales with its registered office at 22 Bruton Street, London W1J 6QE. Company No. 05614477. Spread Co Limited is authorised and regulated by the Financial Conduct Authority. Register No. 446677.