Spread Betting and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67.8% of retail investor accounts lose money when trading Spread Betting and CFDs with this provider. You should consider whether you understand how Spread Betting and CFDs work and whether you can afford to take the high risk of losing your money

CFD Trading for beginners

What is CFD Trading?

The acronym “CFD” stands for contract for difference. Contract for Difference is the name given to an agreement between a trader and a broker in relation to the change in the value of an asset over time.

Of course, there’s plenty to consider before you dive in and start CFD trading This is why we’ve created this beginner’s guide: to provide a simple, jargon-free solution to help you get to grips with everything you need to know.

Once you’ve read this guide, we expect you’ll be itching to give it a go. Even if you don’t think you’re quite ready to join the thousands of other traders here at Spread Co, you can set up a risk-free demo account, just until you’re confident enough to trade for real!

How does CFD Trading work?

Just like spread betting, CFD traders never own a given share, index or commodity. Instead, a CFD trader backs their judgement on whether the value of an asset will go up (going long) or down (going short).

Traders only need to put down a small deposit on a given CFD and this is what is meant by trading on margin. . For example, if a trader trades the Germany30 with an asking price of 100 pence, typically, only 0.50% would be required as an initial deposit.

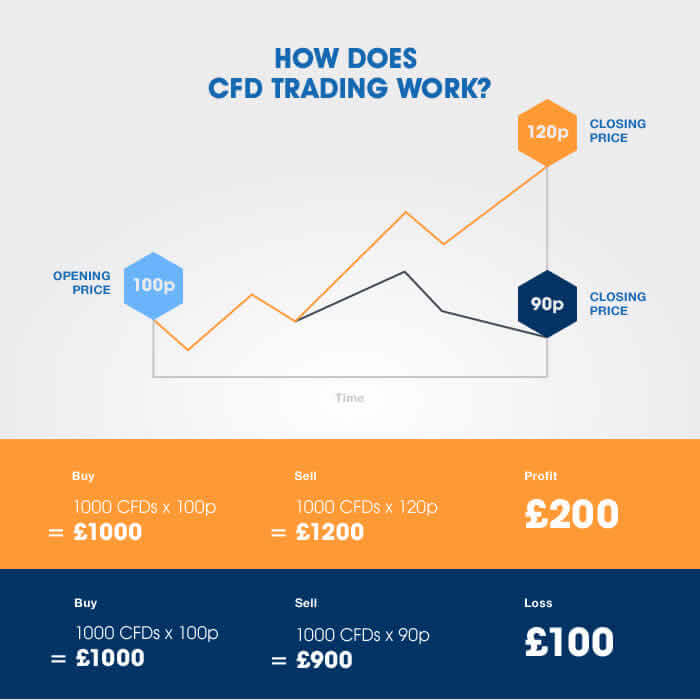

If the trader correctly predicts the outcome of a trade, the seller pays the difference between the initial buy price and the new value of the asset. On the other hand, if the trader gets his/her prediction wrong and the asset moves in the opposite direction, they are expected to pay the difference. An example of a successful trade can be seen below.

What is the spread?

The spread is the name given to the difference between the selling price (or bid) and the buying price (also known as the offer, or ask, price). The bid price is the lower of the two prices and this is what a trader can sell at. .The higher price is the offer, or ask, and this is what the trader can buy at. To find out more about the different types of spread, click here.

What can I trade on?

Here at Spread Co, you can place CFD trades on individual equities, stock indices, currencies and commodities. In some cases it’s possible to trade 24 hours a day, five days a week.

Individual equities(shares):

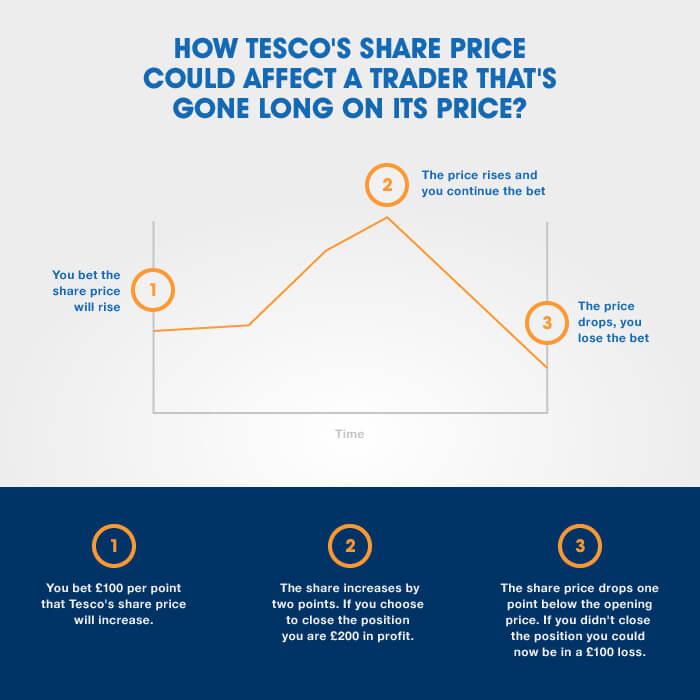

Limited companies such as Tesco, Apple and Facebook are floated on the stock market meaning anyone can invest in them. The shares in these companies rise or fall depending on the overall economic environment or due to factors specific to the company itself - for instance, quarterly earnings, management changes or the appearance of competition in a particular sector.

Stock indices:

Examples of stock indices include the UK100, US30 and Japan225. Each index is made up a selection of the top companies, usually in a particular geographical area. For example, the UK100 includes the top 100 UK companies by market capitalisation.

Commodities:

Commodities include things such as crude oil, gold, silver and copper. The price of these can fluctuate due to a number of factors, including global supply and demand, currency fluctuations and geopolitical considerations.

Currencies:

Just like commodities and share prices, currency pairs also rise and fall in value. Go long if you think the first-named currency in a pair will rise, and go short if you think it'll fall.

How do you place a CFD trade?

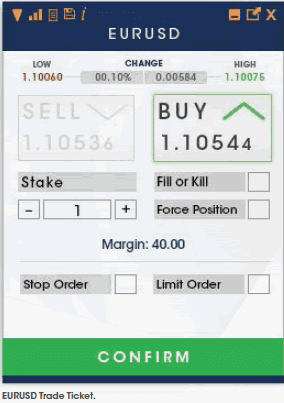

Placing a CFD trade here at Spread Co couldn’t be easier. Once you’ve decided what you’d like to trade on, simply click on the higher “offer” price if you think the price will go up, or the lower ‘bid’ price if you think it will fall.As you’re trading on margin, you’ll need to hold on your account the appropriate minimum deposit required to place your trade. This will be much smaller than the amount required to buy an asset outright.

However, bear in mind that it’s important to hold additional funds (over and above initial margin requirements) on your trading account. Prices are always moving. If they move in your favour then this shows up as a running profit. But if they move against you it’s important to hold variation margin to cover any unrealised loss.

You may want to set a stop limit too , as this will help to limit your losses should you get your prediction wrong.

A limit can also be added – this means your trade will be closed automatically once it reaches a specific level set by you. For example, if you buy (go long) a CFD at a price of 100p, you can set a limit to automatically close this trade if it hits a sell price of 110p. This gives you peace of mind as you won’t have to keep checking your account every five minutes. Alternatively, you can manually close a trade anytime that the underlying market is open. For currencies this is 24 hours a day.

Should I go long or short?

Unfortunately, there is no magic formula when it comes to placing a successful trade , and even the best traders lose occasionally. However, if you’re willing to do a bit of research and keep one eye on current affairs, you’ll be in a much stronger position to make a profit.

Obviously, there’s a lot to look out for, including corporate earnings reports, geopolitical events and economic data releases. But the main trick is to keep your losses small and to run your profits. In this way you can have more losing trades than winners and still make profits. This is why money and risk management is so vitally important.

If you’re not 100% confident but still wish to dip your toes in the world of CFD trading, why not set up a risk-free demo account here at Spread Co? Profits might not be real, but neither will losses. And they’ll still mirror actual market changes so you can see how much you could’ve won (or lost) if you’d traded with real money!

Disclaimer

Spread Co is an execution only service provider. The material on this page is for general information purposes only and nothing contained herein constitutes (or should be taken to constitute) financial or other advice which should be relied upon. It has not been prepared with your personal circumstances, financial situation, needs or objectives in mind, therefore any actions taken or not taken by any person on the basis of this material is done entirely at their own risk. Spread Co accepts no responsibility whatsoever for any such actions, inactions or resulting consequences. No opinion expressed in the material shall amount to (or be taken to amount to) an endorsement, recommendation or other such affirmation of the suitability or unsuitability of any particular investment, transaction, strategy or approach for any specific person. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. As such, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research. Nonetheless, Spread Co operates a conflict of interest policy to prevent the risk of material damage to our clients.

Recent guides

Easy To Open An Account

Reliable Platform

With our platforms you can trade wherever you are – at home, in the office, or when you’re out and about.

0% financing on short index positions

Some companies will charge you to hold a short index position. At Spread Co we won’t.

Powerful Charting

Spread Co charts are powered by TradingView Inc.

Sign Up For A Demo Account Create A Live AccountStart here

Markets

Spread Co Limited is a limited liability company registered in England and Wales with its registered office at 22 Bruton Street, London W1J 6QE. Company No. 05614477. Spread Co Limited is authorised and regulated by the Financial Conduct Authority. Register No. 446677.